non ad valorem tax florida

3 rows Tax collectors are required by law to annually submit information to the Department of Revenue on. Office of the Monroe County Tax Collector 1200 Truman Ave Ste 101.

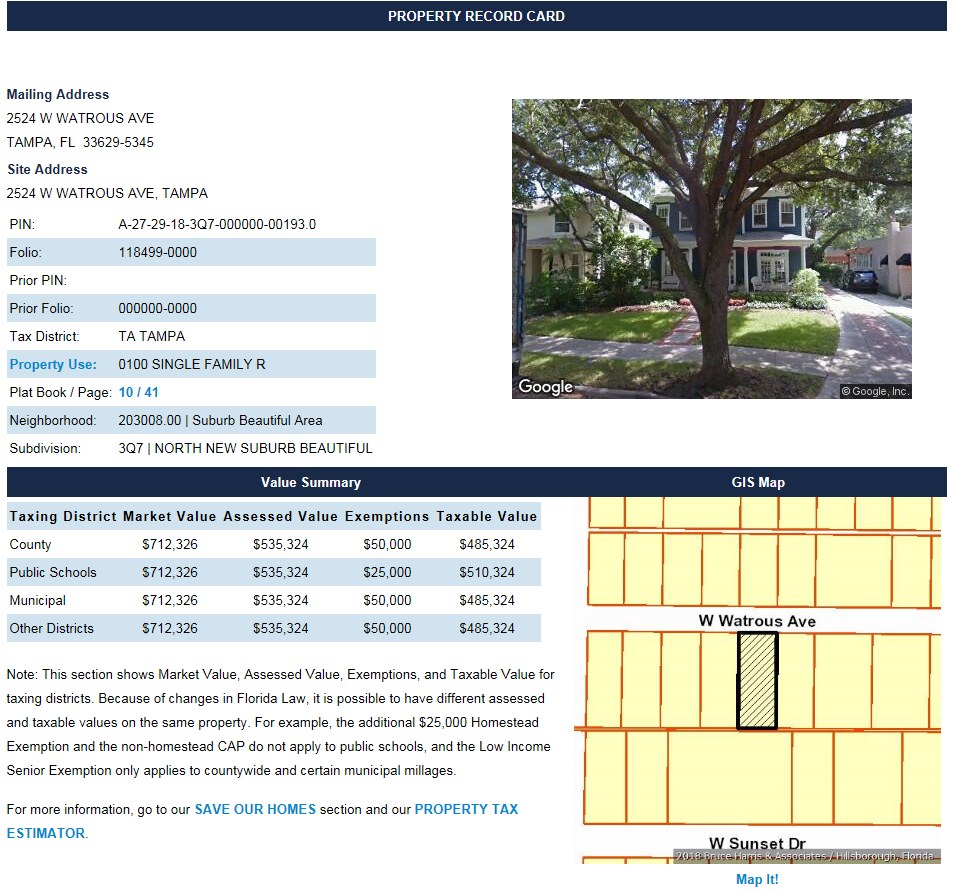

Estimating Florida Property Taxes For Canadians Bluehome Property Management

What is a special or non-ad valorem assessment.

. They are NOT considered property taxes for Schedule A although some exceptions may apply see comments below. Progress Energy 800 228-8485 Florida Power Light 800 226-3545 SOLID WASTE CUSTOMER SERVICE. The Palm Bay case and FS.

FLORIDA PROPERTY TAX CALENDAR TYPICAL YEAR DOR DEPARTMENT OF REVENUE PA PROPERTY APPRAISER TC TAX COLLECTOR VAB VALUE ADJUSTMENT BOARD MONTH. An elected board shall have the power to levy and assess an ad valorem. In Nassau County all non-ad valorem special assessments are a flat rate with the exception of SAISSA which uses a value-based calculation.

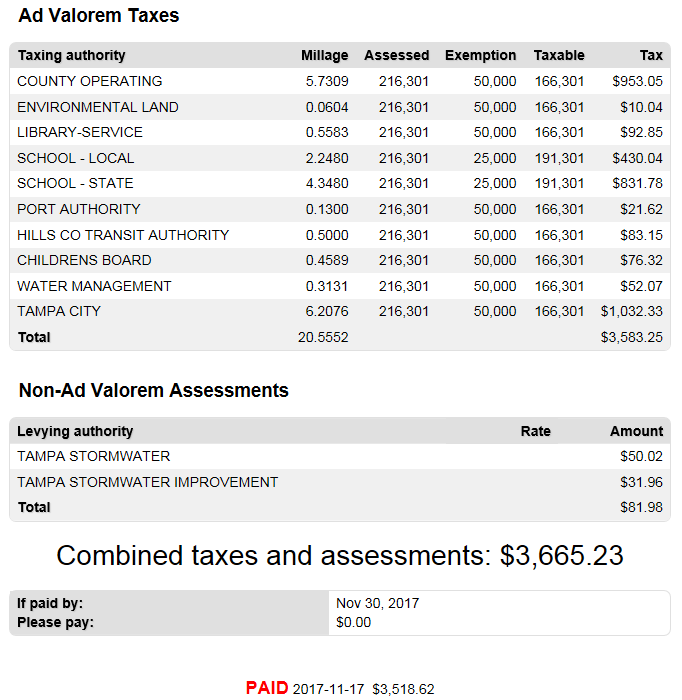

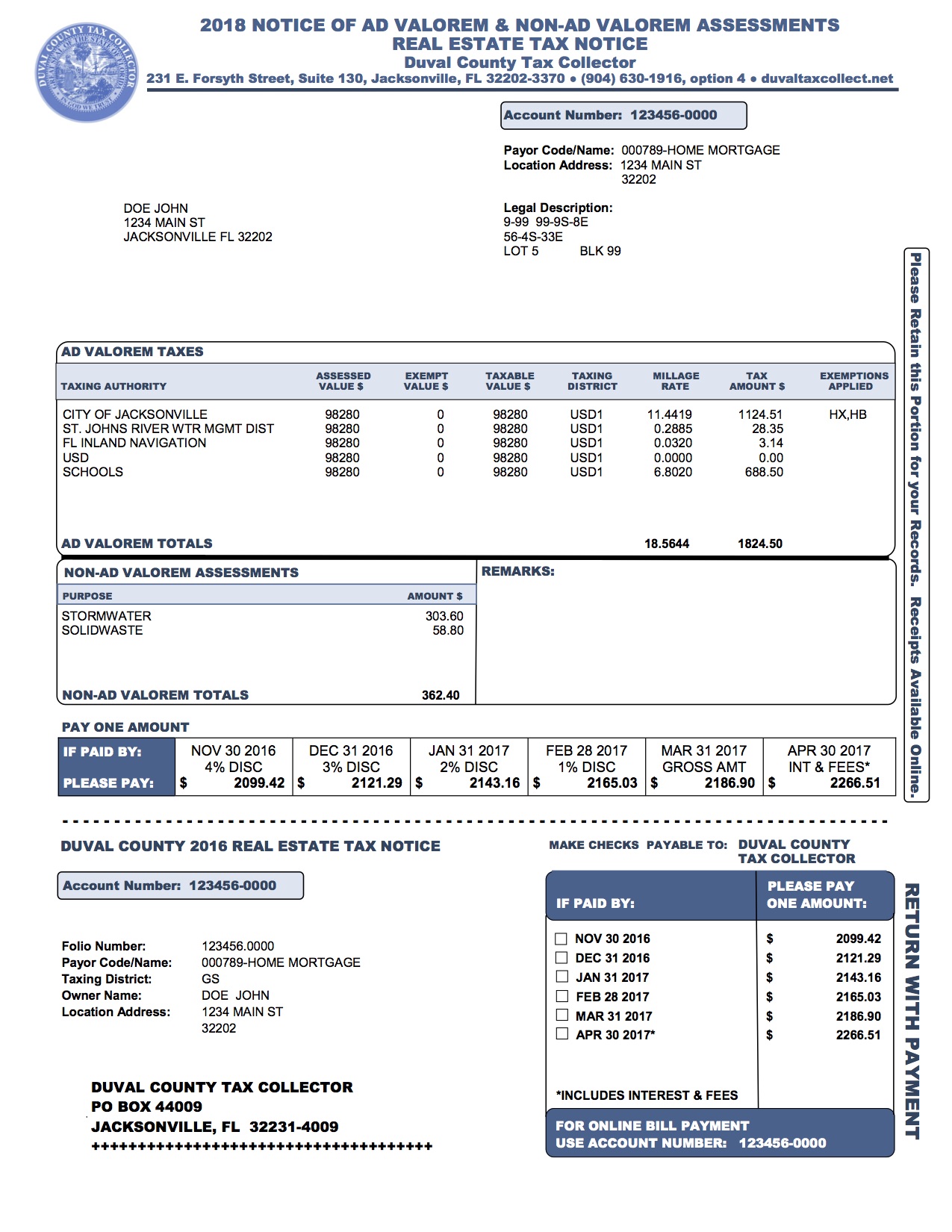

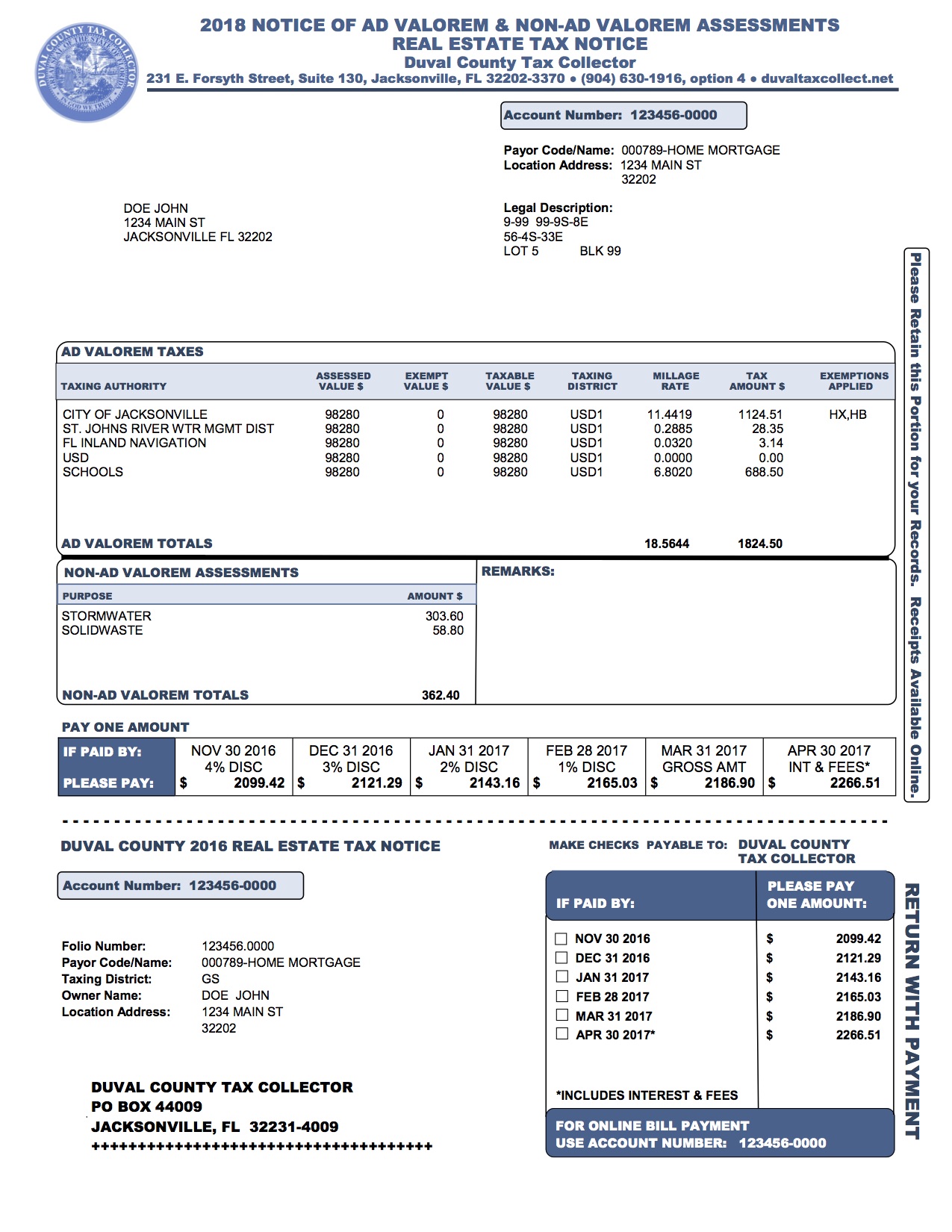

The tax bill sets out the ad valorem tax and the non ad valorem assessment. Commonly referred to as property tax. 1 Ad valorem taxes and non-ad valorem assessments shall be assessed against the lots within a platted residential subdivision and not upon the subdivision property as a whole.

NON-AD VALOREM ASSESSMENTS AND SPECIAL ASSESSMENTS. CUSTODIAN OF PUBLIC RECORDS. Tax based upon the value of the property.

Should a non-ad valorem. Taxes on all real estate and other non-ad valorem assessments are billed collected and distributed by the Tax Collector. The collection of taxes as well as the assessment is in.

Pollution Control Devices for Ad. See Florida Statutes 101. INCLUDED ON YOUR PROPERTY TAX BILL Non-Ad valorem assessments are billed.

Both the ad valorem tax and the non ad valorem assessment are due November 1st of each year in order to take advantage of the 4 discount not the focus of this blog Authority for Ad Valorem Taxes. Each special assessment board calculates the. 1 AD VALOREM TAXESAn elected board shall have the power to levy and assess an ad valorem tax on all the taxable property in the district to construct.

Non-Ad Valorem assessments are primarily assessments for paving services storm water and solid waste collection and disposal. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. TRIM is an acronym for the.

What is an ad valorem tax. 1 AD VALOREM TAXES. Article VII of the Florida Constitution and Chapters 192 193 194.

NonAd Valorem Assessment Period for which services are rendered and assessed on Nov 2021 Tax Bill Miramar Storm Water October 1 2021 through September 30 2022 Monterra. They may be expenses for other items though like rental property or businesses. Florida Department of Revenue Property Tax Oversight PT -111112 R.

Under the new law if you owned a home in Florida as your homestead and you were exempt from property taxes. The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem assessments. The real estate tax bill is a combined notice of ad valorem taxes and non-ad valorem.

The Property Appraiser establishes the taxable. Non-ad valorem assessments collected within their own area include. 3 Within 20 working days after receipt of the certified ad valorem tax roll and the non-ad valorem assessment rolls the tax collector shall send to each taxpayer appearing on such rolls whose.

Exemption from Property Taxation Ad Valorem taxes only. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and. The 2021 Florida Statutes.

Real estate taxes comprise ad valorem taxes and non-ad valorem assessments while personal property taxes are solely ad valorem. Tangible taxes are not subject to non-ad valorem assessments Examples of. Non-ad-valorem assessments are based on the improvement or service cost allocated to a property and are levied on a benefit unit basis rather than on value.

162 could thus lead to a constitutional challenge against the collection of nuisance abatement costs on tax bills. Tax bills are mailed on or around November 1 each year.

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

What Is A Florida County Real Property Trim Notice

What Is A Non Ad Valorem Tax Miami Real Estate Lawyers Fleitas Pllc

Florida Property Taxes Explained

County Property Tax Payment Deadline Jennifer Sego Llc

Exemptions Hardee County Property Appraiser

Real Estate Taxes City Of Palm Coast Florida

Tax News And Information Lower Your Property Taxes With Property Tax Professionals

Real Estate Property Tax Constitutional Tax Collector

Understanding Your Installment Payment Plan Ipp Bill Constitutional Tax Collector

Understanding Your Tax Notice Highlands County Tax Collector

Nobody Likes To Pay Taxes And Mehmet Bayraktar The Developer Of Island Gardens Seems To Be One Of Those Folks Ad Valorem Taxes Become Delinquent On April 1st And When They Do The Property Owners Start Getting Notices To That Effect From The Miami

A Guide To Your Property Tax Bill Alachua County Tax Collector

Understanding Your Tax Bill Seminole County Tax Collector

Broward County Property Taxes What You May Not Know

Estimating Florida Property Taxes For Canadians Bluehome Property Management

What Is This Trim Notice I Received From The Property Appraiser Lubin Law Property Tax Appeals South Florida